Published

May 10th, 2016

edit

replace

rm!

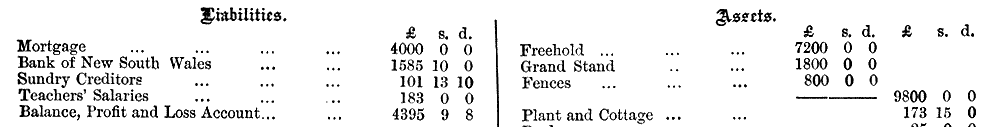

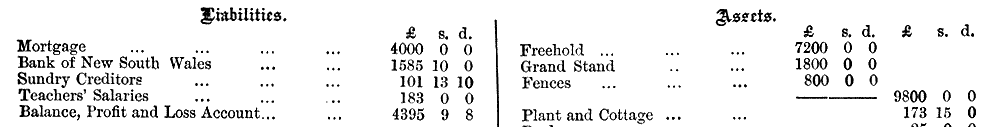

Balance sheets are useful terms from accounting showing a snapshot of the financial state of a company. Balance sheets consists generally of 3 columns:

- Assets

- Liabilities

- Equity

These map directly to the Rights and Obligations I rambled on about a couple of weeks ago.

An Asset is a Right and a Liability is an Obligation, just with numbers assigned to it. The Equity I will get to shortly.

Published

May 3rd, 2016

edit

replace

rm!

In my previous article I talked about Rights and Obligations and how they apply to blockchains.

If you have the right to someone’s obligation there may be a risk that the other party can’t (or won’t) comply. This is called Counter-Party risk.

A simple example of counter-party risk is if you lend money to your nephew who lives on his parents couch playing computer games all day long, there is a risk he doesn’t pay it back.

Differences in counter-party risk explains the differences in prices for currencies and shares. It also explains why different levels of risk provides different interest rates, both for personal loans and for individual country’s bond rates.

There are whole industries of rating agencies that are supposed to analyze this risk and allow people to take this risk into account.

Published

April 21st, 2016

edit

replace

rm!

Rights and Obligations are the 2 most fundamental building blocks of trade and finance. Contracts exist to protect rights and enforce obligations. Trade consists of trading one right or obligation for another.

They are also fundamental in understanding how Financial Systems, Blockchains and Smart Contracts work, yet most people haven’t really thought too much about what they actually work.

I believe it is vital to understand and think about these basic concepts to be able to successfully understand Bitcoin, Ethereum and eventually replace the traditional financial instruments and systems that are all based on this.

This article is a quick introduction rights and obligations and how to think about them in financial applications, in particular when writing Smart Contracts.

Published

April 7th, 2016

edit

replace

rm!

If you haven't read the first article in this series I recommend you go read it first: Ethereum vs Mossack Fonseca: The IBC and it’s blockchain alternatives

Trusts are an ancient contract structure going back to Roman days. A trust is used to separate control from the benefits of an asset.

Traditionally a trust is used by a rich father to ensure that his wealth is not spent away by his no-good spendthrift kids.

Published

April 6th, 2016

edit

replace

rm!

Whatever your opinions about the Panama Papers saga. There are both perfectly legitimate and absolutely illegal ways of using the services of an Offshore Trust company like Mossack Fonseca.

Ethereum through it’s Smart Contracts can actually replace many of the legitimate ways of using offshore structures, while at the same time make some of the illegal ways less useful.