Updated 4/21/2016: Updating this as this is also now affecting the Gift Card industry. Added crypto currencies in general. Moved hosted crypto currency wallets like Coinbase and UpHold up to a 3 since the industry has changed a lot since 2012 (No more BitInstant or Coinbase). Removed Liberty Reserve for obvious reasons and modernized it a bit.

About 15 years ago after a bunch of E-Gold exchangers lost money from fraudulent purchasers performing chargebacks Start e-gold app developer JP May published his May Scale of Money Hardness (only on wayback machine now).

The idea is that the easier it is for a payment to be reversed, the softer it is. I’m trying to update it for 2012 (now 2016) so the next generation of financial startups don’t get burnt more than they already have been and learn the lessons learnt by the e-gold community.

Original May Scale

| Hardness |

Item |

| 1 |

Street cash, US dollars |

| (Hard) |

|

| 2 |

Street cash, euro currencies, japan |

| 3 |

e-gold |

| 4 |

Street cash, other regions |

| 5 |

Interbank transfers of various sorts (wires/ACH etc), bank checks |

| 6 |

personal checks |

| 7 |

Consumer-level electronic account transfers (eg bPay) |

| 8 |

Business-account-level retail transfer systems |

| (Soft) |

|

| 9 |

Paypal and similar ‘new money’ entities, beenz |

| 10 |

Credit cards |

| (Ridiculously soft) |

|

Updated May Scale

| Hardness |

Item |

| 1 |

Street cash, BitCoin and other intrinsic crypto currencies like Ethereum and DASH, Gold/Silver Coins |

| (Hard) |

|

| 2 |

Western Union and other money transmitters |

| 3 |

Account based electronic currencies fire walled away from banking system (e.g. UpHold, CoinBase, BitGold) |

| 4 |

International wires |

| 5 |

bank checks |

| 6 |

ACH, personal checks |

| 7 |

Consumer-level electronic account transfers (eg Dwolla, AlerPay) |

| 8 |

Business-account-level retail transfer systems, credit cards (brick and mortar) |

| (Soft) |

|

| 9 |

Credit cards (via internet or phone) |

| 10 |

PayPal |

| (Ridiculously soft) |

|

updated 3/8/2012 Based on comments I moved things around a bit. Ordinary bank wires are more less reversible than ACH’s. The scale shouldn’t cover default risk only reversal risk so I’ve moved all street cash to 1. and added gold/silver coins to it. I’ve added electronic currencies like Liberty Reserve that are fire walled away from the banking system to 3. Any account based system that interfaces directly with the banking system will be in 7, so AlertPay belongs with Dwolla as their banking connections can also put undue pressure on them. I still consider Personal checks risky. At least until it clears so I’m leaving that at 6. Also see The BitCoin Wiki’s Payment Method page for alternative rating

Why do I place Dwolla above PayPal? Mainly because they exclusively use the ACH system and not the credit card system, which makes it harder for people to perform chargebacks.

Why is PayPal below Credit Cards then? While it is a blended system of ACH and CC, their risk management procedures makes it even more risky to merchants than using a straight credit card processor. Just by virtue of being successful or having one or two chargebacks they will freeze your accounts.

What can we learn from the May Scale?

Purchasers benefit by having softer money as it reduces risk for them and merchants benefit by having harder money.

If you are selling game credits, subscriptions to a web service without any significant cost to you the benefits and ease of accepting soft money is fine.

It is slightly trickier for merchants sending physical goods to users. The merchant does have a risk, but the shipping infrastructure does provide some insurance and documentation that partly alleviates it.

If you are selling financial instruments, real estate, cars and other high value items you should not accept anything higher than 5 on the May scale. As a matter of fact due to anti money laundering laws since the original May scale was written you probably shouldn’t accept anything less that 5 either.

If you sell BitCoin you are in a little bit of a different situation similar to e-gold exchanges of yore, due to the growing hostility to it from financial institutions and governments. Depending on how high your spread or transaction fee is you could accept the risk of accepting bank transfers, in particular if you limit the size and frequency of transactions with customers until you feel you can trust them. But I would probably stick to 3 or below.

One risk potential risk with Number 3 is that you might accept a Western Union transfer from a party who is on the terrorist watch list, in which case you could get associated with them. This is a particular risk if you are not registered with the FSA (in the US) or similar elsewhere and did not perform some level of Know Your Customer.

Why soft money?

Most of the soft money is based on book entry systems with central authorities. One of the benefits of this is that in case of fraud it is possible to contact this central authority and reverse a transaction.

BitCoin is also a book entry system, but there is no central authority so there is no way of reversing a charge.

So if you as a consumer buy some coffee with BitCoin and the merchant doesn’t send it you there is no real recourse unless you know who the merchant is and are able to take the merchant to small claims court.

Because of this there is a trend within the BitCoin community of having centralized BitCoin denominated book entry systems that temporarily keep the funds in a reversible place. 4/21/2016: Do these even exist anymore? There are also BitCoin escrow agents. These are potentially good solutions, of course you also need to trust the operators of these or they may just run away with your BitCoin. There were probably more fraudulent than trusty escrow services in the e-gold days. I would expect the same with BitCoin.

There is also a risk to the merchant in BitCoin. See the recent Linode Bitcoin fiasco. If they were using softer money they could have called the central authority (PayPal etc), freeze their account and have dodgy transactions reversed.

Anyway none of this is easy. If you are trying to do something with BitCoin or other kinds of alternative financial services you need to think about it for your business.

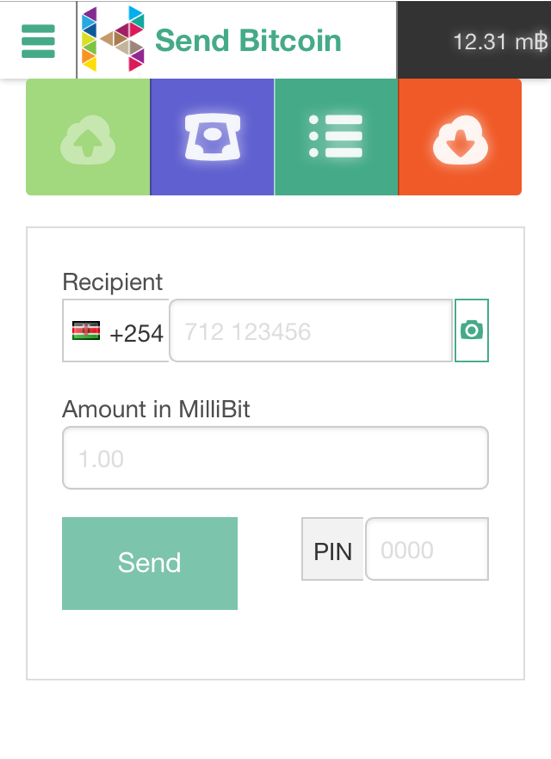

Kipochi the startup I helped found 3 years ago is in the news again. While the whole story ended up pretty painful for me I did learn a lot from the experience. It's been a while now so I think it's time to tell the story from the inside.

Kipochi the startup I helped found 3 years ago is in the news again. While the whole story ended up pretty painful for me I did learn a lot from the experience. It's been a while now so I think it's time to tell the story from the inside.